Present Value Calculator Excel Template

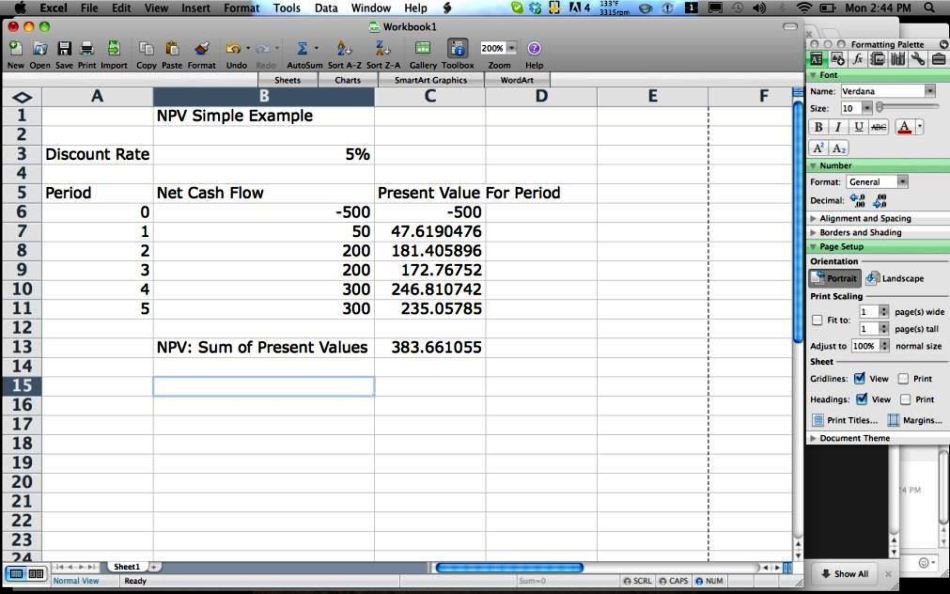

Present Value Calculator Excel Template - You will appreciate being able to calculate the present value of an annuity. Web npv is an essential tool for corporate budgeting. Web = pv (rate, nper, pmt, [fv], [type]) where: Web learn how to calculate the present value of a single or series of cash flows using the excel pv function, with examples and formulas. Odoo.com has been visited by 100k+ users in the past month While you can calculate pv in excel, you can also calculate net present value(npv). In other words, you can find out the value of future incomes. Web 2) the xirr, xnpv calculator in the screenshot on the right uses excel's xnpv and xirr functions to calculate net present value and internal rate of return. Web our free present value calculator template enables you to compare two investment scenarios. It is used to determine the. The big difference between pv and npv is that npv takes into account the initial. Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal. Number of payment periods pmt: Web fv is one of the core financial functions in excel. Web the net present. Web how to compute compound interest in excel? The web page explains the formula for. Web learn online now what is present value? Web fv is one of the core financial functions in excel. Net present value is the difference between the pv of cash flows and the pv of cash outflows. Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better. Web learn how to calculate the present value of a single or series of cash flows using the excel pv function, with examples and formulas. Web fv is one of the core financial functions in excel. Web the net present. While you can calculate pv in excel, you can also calculate net present value(npv). Web how to compute compound interest in excel? Net present value is the difference between the pv of cash flows and the pv of cash outflows. The big difference between pv and npv is that npv takes into account the initial. Use the excel formula coach to find the. Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. Web learn online now what is present value? Web npv is the value that represents the current value of all the future cash flows without the initial investment. Web learn how to calculate the present value of a single or series of cash flows using the excel pv function, with examples and formulas. Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Number of payment periods pmt: Odoo.com has been visited by 100k+ users in the past month It is used to determine the. You can use excel to calculate npv instead of figuring it manually. Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better. The present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now.

Professional Net Present Value Calculator Excel Template Excel TMP

Net Present Value Calculator Excel Template SampleTemplatess

Net Present Value Calculator Excel Templates

An Npv Of Zero Or Higher Forecasts.

Web [Enlarge] Net Present Value (Npv) Is A Common Financial Calculation Used To Determine The Profitability Of An Investment Or Project.

Present Value Is Discounted Future Cash Flows.

The Web Page Explains The Formula For.

Related Post: